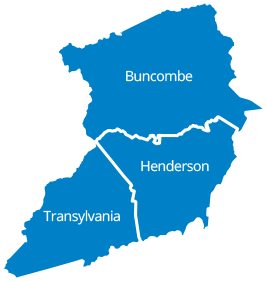

SERVICE TO YOU

As your State Senator, I am committed to helping the citizens of the 48th District. This

website was designed to keep you informed and to help guide you towards help or assistance

in many ways. If you’d like to recognize a special achievement, need help with an agency,

need a list of resources, or simply would like to meet with me- this site can help us.

Sen. Edwards Supports $125 Million Funding to Launch NC COVID-19

Rapid Recovery Loan Program

In response to economic losses related to Coronavirus (COVID-19), Senator Edwards voted in

support of [X BILL] that recognizes the critical role small businesses play in our state's

economy. The bill provides $125 million in funding to the Golden LEAF Foundation to

establish the Rapid Recovery Program to

support NC small businesses and family farms.

Senator Edwards Supports Reopening NC Business During COVID-19

Sen. Edwards voted to support various bills that would reopen NC businesses and get citizens

back to work during the COVID-19 pandemic.

Sen. Edwards Helps Secure Largest Economic Development Project

in WNC

International aerospace manufacturer Pratt & Whitney is investing $650 million in a

Buncombe County facility to manufacture jet engine parts and consolidate some worldwide

operations.

This massive investment is a testament to western North Carolina's work ethic, skill, and

ingenuity

Sen. Edwards to Introduce Bill to Defund Cities that Defund

Police

The morning after the Asheville City Council voted to defund its police department, Sen Chuck

Edwards (R-Henderson) announced his intent to file legislation to defund cities that defund

the police.